Public

Ball Corporation - Europe & Asia

Ball Corporation - South America

Ball Corporation Blog

Ball Corporation Catalog

Ball Corporation Gallery

Ball Corporation Locations

Ball Corporation News

Ball Corporation- North America

Ball Corporation Videos

If this is your company, CONTACT US to activate Packbase™ software to build your portal.

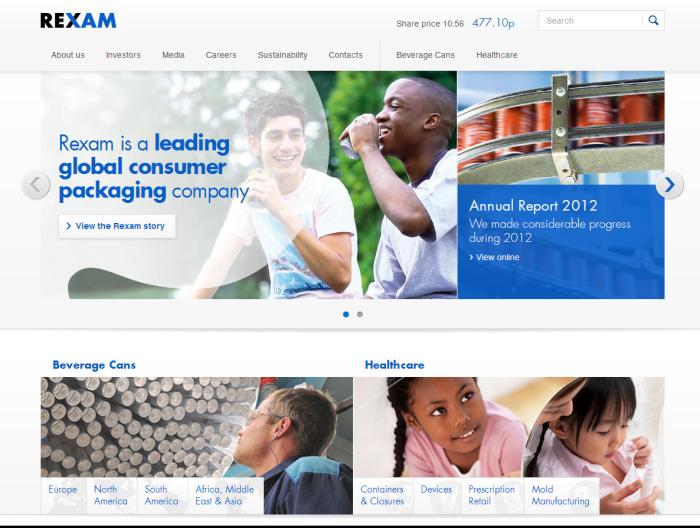

A classic business to business company, Rexam is a leading global beverage can maker and one of the global leaders in rigid plastic packaging for healthcare applications.

Rexam makes high quality packaging as efficiently, profitably and sustainably as possible. All the while ensuring the safety and well being of its people and the satisfaction of customers, which include many of the world's favourite and most famous brands.

Rexam prides itself in achieving a balance between profitable revenue growth, cash generation and the appropriate risk profile for the group to deliver a steady increase in profit year on year and create value for shareholders.

The Rexam PLC Board of Directors is responsible for the sustainable long term success of the Group, which it does through its focused leadership, and the development, review and implementation of the Group's strategy. Its other roles are to maintain control over the Group's assets, to monitor changes to the Group's management and control structures, to establish high ethical standards of behaviour, to develop robust corporate governance and risk management practices and procedures, and ensure that its obligations to its shareholders are understood and met.

Rexam, the global consumer packaging company, announces its results for the full year 2013.

| 2013 | 2012 restated2 |

Change | |

| Continuing operations underlying performance1 | |||

| Sales (£m)5 | 3,943 | 3,885 | 1% |

| Underlying operating profit (£m)1 | 449 | 448 | 0% |

| Underlying profit before tax (£m)1 | 372 | 358 | 4% |

| Underlying earnings per share (pence)1 | 5.3 | 31.2 | 13% |

| Total operations6 | |||

| Total underlying earnings per share (pence) | 40.6 | 36.6 | 11% |

| Total dividend per share (pence) | 17.4p | 15.2p | 14% |

Highlights

- Underlying profit before tax up 4%

- Underlying earnings per share up 13%

- Return on capital employed 15.5% (2012: 14.5%3)

- Sale of the majority of Healthcare agreed for $805m with £450m of proceeds to be returned to shareholders

- Total dividend up 14% to 17.4p

Commenting, Graham Chipchase, Rexam's Chief Executive, said: "We are pleased to have achieved our 15% ROCE target. We also grew 2013 profits by 4% and have proposed a 14% increase in the dividend to 17.4p. It has been a great team effort.

"The acquisition of a majority stake in UAC expands our footprint in the Middle East, while our investment in Magnaparva Packaging demonstrates our intent to pursue transformational innovation opportunities.

"Rexam is now a focused beverage can maker, and our aim is to be the best in the industry. The work that we have done to restructure our company means that we are in good shape operationally. In 2014, despite an uncertain macroeconomic environment and some continued cost volatility, we expect to make further progress on a constant currency basis. We remain committed to managing what we can control and focusing on cash, cost and return on capital employed as we pursue our strategy of balancing growth and returns."

Statutory results4

| 2013 | 2012 restated2 |

|

| Sales (£m)5 | 3,943 | 3,885 |

| Profit before tax (£m)5 | 339 | 319 |

| Total profit for the year (£m)6 | 95 | 206 |

| Total basic earnings per share (pence)6 | 12.0 | 23.7 |

- 1 Underlying business performance from continuing operations (excluding Healthcare and Personal Care) before exceptional items, the amortisation of certain acquired intangible assets and fair value changes on certain operating and financing derivatives.

- 2 Restated for adoption of IAS19 (Revised) 'Employee Benefits' and reclassification of Healthcare to discontinued.

- 3 Restated for IAS19 (Revised) 'Employee Benefits'

- 4 Statutory results include exceptional items, the amortisation of certain acquired intangible assets and fair value changes on certain operating and financing derivatives.

- 5 Continuing operations.

- 6 Includes discontinued operations.