Key Consideration #3: Commercial Goods

Let’s examine four considerations:

- Target Cost of Goods

- Timeline

- Brand Requirements

- Visual Appeal

There can be a lot of ground to cover when it comes to cost of goods, so we’ll cover the basic considerations. First, dollars per pound of different resins can impact material choice; dollars per pound of resin A may make more sense compared to dollars per pound of resin B. Shipping empty bottles versus shipping closures impact cost because the empty bottles take up much more space than closures.

Second, identifying the proximity of manufacturers to fillers is something to think about in regard to cost. Third, cavitation drives unit prices, so even if a PET bottle is more expensive pound for pound, if the cavitation is higher than HDPE, that could change your cost calculations. Finally, if the packaging components are complex and require assembly, the vendor’s capability or lack thereof to automate this process, could impact both material and design selection.

It’s Never too Early to Think About Timelines

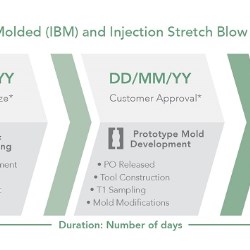

Early. Early. Early. That’s when you should think about timelines in relation to your required product launch date. Pending the process and design complexity, the timeline to commercialization may change, so you need to think about how these factors may impact your timeline. For example, an Injection Molded (IM) component typically takes longer to commercialize than an Extrusion Blow Molded (EBM) component, so if you need a cap and a bottle the IM component would be the timeline driver.

There is a lot to deliberate when it comes to choosing the right packaging materials; it truly can be a tricky maze. The same can be said for balancing your brand requirements with your product’s stability and compatibility needs. For example, your brand’s DNA or positioning statement may encourage the use of certain materials that could negatively impact the product’s shelf life. Stability and compatibility trump all other considerations; it’s still the foundation, it’s still priority one. But will an ugly yet stable package help you sell product?

We don’t deny the importance of a product’s visual appeal or shelf impact. It’s the First Moment of Truth. It’s those precious few seconds after a shopper first encounters your product on the shelf that you have the best chance of converting a browser into a buyer. If you can get the shopper to pick up the product, the shopper is 10x more likely to purchase the product.

Take for example, the development of a new, custom, single-serve beverage. From a product compatibility standpoint, the best material might be glass. But as a brand owner you need to consider, whether or not a Pressure Sensitive (PS) label on glass is going to allow you to have the shelf impact you’re looking for. It’s a constant balancing act between meeting the stability and compatibility requirements without compromising the visual appeal or decorating possibilities.

Material selection matters, part 1

Material selection matters, part 2

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)